Attention CEOs and Mortgage Lenders

Remember Blockbuster, Kodak, and Blackberry?

Blockbuster had the opportunity to BUY NETFLIX for just $50 Million.

They didn’t see that the MARKET was MOVING to streaming their entertainment ONLINE.

Today Netflix is doing BILLIONS in revenue per year.

odak actually invented the first digital camera. The shelved it because they didn’t believe that the MARKET would move to prefer digital images over film pictures.

Blackberry didn’t pivot when the MARKET flooded into the iPhone’s app store and put the most popular websites right on our phones.

That was the pivot from ANALOG TO DIGITAL.

The “unbeatable” giants of industries were disrupted and new players made BILLIONS of dollars riding the MARKET SHIFT.

TODAY we are living through the next shift. From Digital to AI Powered.

THE MARKET is moving from Google search to using A.I. assistants!

The companies that understand how to get the A.I. Assistants (Chat GPT, GROK, Gemini, Claude, Perplexity, etc.) to recommend their business are going to capture this next massive MARKET shift and are going to be the disrupters of the future.

Yes, within 5 years we will have autonomous AI robots in our homes, folding our laundry, cooking our food, cleaning our homes, all while simultaneously talking to us and answering our questions.

Consider this …

Today there are 2.3 BILLION prompts per DAY on ChatGPT.

There are 16.4 BILLION Searches on Google.

Yes, In less than two years, ChatGPT has captured 16 percent of global search volume and our customers trust it’s answers and recommendations just as much as a personal referral!

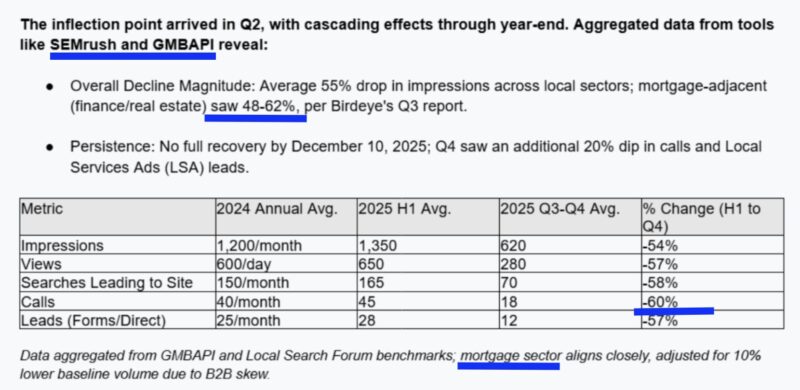

Combine that with the latest study that shows in Q3 and Q4 in the mortgage industry PHONE CALLS FROM BUSINESS PAGES were down 60%!

Borrowers are realizing that they no longer have to spend hours of time Googling questions, reading websites, guessing at rates, and reading reviews.

They can now simply put their AI into deep research mode, ask the questions of how to get approved for a specific mortgage, who to trust and who to call.

I does the work, searches all the online sites, reads the conversations and reviews, and simply gives the answer in seconds.

If your brand does not have a strategy to build authority with AI and LLM’s, you are already falling behind.

This is not a future shift.

It is already happening.

Right now.

The difference between the companies that are going to be replaced and the new industry giants is speed and the QUALITY OF AI IMPLEMENTATION across the ENTIRE ORGANIZATION.

This transition is happening faster than mobile, faster than social, faster than search ever did.

Which leads us to the question … How do the mortgage companies and professionals of today become the Authority leaders with AI and start generating referrals from AI assistants?

Here’s The 5 Step AI Authority Process We Have Built To Build Authority in a COMPLIANT, SCALEABLE Way.

STEP 1: Find the Highest Value and Most Common LOCAL Frequently Asked Questions

AKA Market Research

Our system runs every week and researches the top local borrower questions based on the Loan Officer’s location and desired client or loan type.

The system understands where each Business Profile already has authority and selects the topic with the greatest opportunity for that specific week.

It then performs a deep dive using the latest AI research modes to build a comprehensive knowledge base around that specific Q&A topic.

OUR SYSTEM THEN GIVES THE LLM FEEDBACK AND TRAINS IT ON THE BEST WAY TO COMPILE THAT INFORMATION INTO USEFUL CONTENT FOR CUSTOMERS.

This achieves two outcomes. It builds authority for your brand inside AI systems while also creating a high value knowledge resource for the mortgage branch.

STEP 2: Use AI to create content while TEACHING the AI that you are the expert.

Every week each MLO’s custom deep research is then turned into a suite of content designed so that the LLM’s can reference snippets from the published content to help answer clients questions when they ask them on Google OR inside an AI assistant.

The system creates:

- A blog (structured properly and submitted to the compliance dashboard for approval)

- An email newsletter that is cued up to send to past clients and real estate referral partners.

- A “Did you know” post that can be copied and pasted on community sites like Reddit, Quora, Facebook groups and more.

All content sits inside a dashboard where the corporate compliance department and the loan officer can make edits and publish the content once it is approved.

NOTE

Our system is built so that every edit that is made in the compliance dashboard feeds into the individual AI for that MLO so that the content gets more and more like the user and dramatically reduces compliance approval times as the AI learns from the edits.

This creates personalized unique content in each market, for each loan product, for each loan officer at scale across the entire organization.

STEP 3: Authority Content Syndication at Scale

Authority is not built in one place. Getting AI to recommend your content and your brand to new consumers depends on having your content present everywhere AI systems look when answering questions.

Once content is created and approved, it is automatically syndicated across key channels. This includes press distribution on sites like NBC, CBS, FOX, BNN, your corporate blog, personal web properties, and email newsletters.

This creates consistent signals across the web that reinforce your brand as an active and trusted source, while giving AI current content it can surface to users who are actively asking questions.

Syndication is fully automated, ensuring your message stays fresh, visible, and aligned without adding operational burden to your team.

The goal is simple.

Use AI to identify the top questions consumers are searching online, then deploy a system that understands corporate compliance and delivers accurate answers to the market at scale.

STEP 4: Social Media Content Creation, Distribution, and Engagement

AI is actively scanning social media platforms to identify loan officers who are engaging communities, creating value, and building real influence.

Our platform creates AI generated social content that reinforces your authority content while driving consistent backlinks and engagement signals.

Each post is intentionally designed to point back to your owned assets, improving discoverability and strengthening the trust signals that AI systems rely on.

Posting is automated, structured, and aligned with your broader authority strategy so your brand stays active without manual effort.

Our platform archives all published content, comments, and Direct Message conversations across social media platforms to support full compliance oversight.

When a new comment or message comes in, our Mortgage AI drafts the response and routes it to the Loan Officer for approval and into the compliance dashboard before publishing.

STEP 5: Comments & Reviews

Maintaining the exact same Name, Address, Phone Number, and Website across ALL online business directories is the number one recommendation from AI for getting served inside the AI knowledge panel within ChatGPT.

Our system provides each Loan Officer with a simple dashboard to verify, update, and post updates directly to their Google Business Profile.

Once the profile is properly optimized, the system automatically pushes that verified information to more than 70 of the highest quality local business directories that both AI systems and Google rely on for trusted data.

Our platform includes pre-built review request emails and text messages that can automatically trigger once a loan funds.

If a review with fewer than four stars is received, it is routed into a customer satisfaction notification system and is not published publicly.

All five star reviews are published to Google, and clients are then encouraged to share their experience across community platforms that AI actively monitors for feedback, including Quora, Reddit, and Facebook groups.

All reviews are monitored, organized, and surfaced in a way that highlights credibility, consistency, and real customer feedback.

This layer strengthens your authority footprint by showing that your business is not only visible, but trusted, current, and actively engaged.

The AI Mortgage App Does All of This for Your Entire Organization

This is not a collection of tools. It is a cutting edge platform built from scratch that only a handful of the largest lenders in the nation are going to get access to.

It is a unified enterprise AI authority system built specifically for national mortgage organizations.

AI Mortgage App runs this entire process across your brand, locations, and teams so your organization stays visible, compliant, and trusted as search continues to shift toward AI.

No manual coordination.

No fragmented vendors.

No outdated strategies.

Just a single platform designed to ensure your mortgage organization is understood, verified, and recommended by AI driven discovery.

To have a conversation about your online brand request information today.